Business Insurance in and around Gillette

One of Gillette’s top choices for small business insurance.

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected accident or mishap. And you also want to care for any staff and customers who become injured on your property.

One of Gillette’s top choices for small business insurance.

This small business insurance is not risky

Small Business Insurance You Can Count On

Our business plans rarely account for every worst-case scenario. Since even your brightest plans can't predict global catastrophes or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your future with coverage like errors and omissions liability and a surety or fidelity bond. Fantastic coverage like this is why Gillette business owners choose State Farm insurance. State Farm agent Todd Butzine can help design a policy for the level of coverage you have in mind. If troubles find you, Todd Butzine can be there to help you file your claim and help your business life go right again.

Don’t let concerns about your business keep you up at night! Contact State Farm agent Todd Butzine today, and learn more about how you can meet your needs with State Farm small business insurance.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

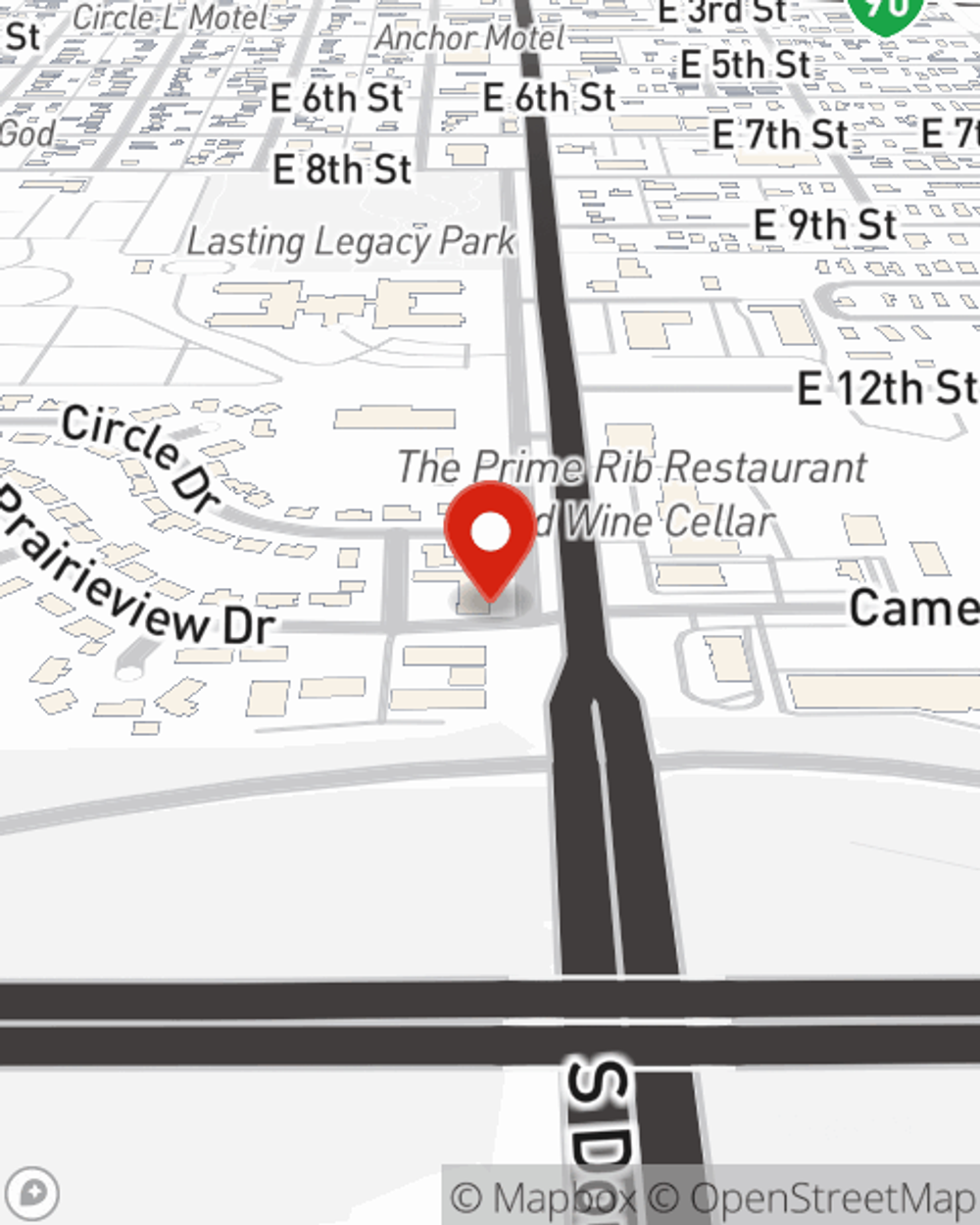

Todd Butzine

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?